Debt is no laughing matter. If you’re at the point at which your debt is making you sick, it’s time to make a change.

Below are thirteen ways you can pay off your debt fast and for good.

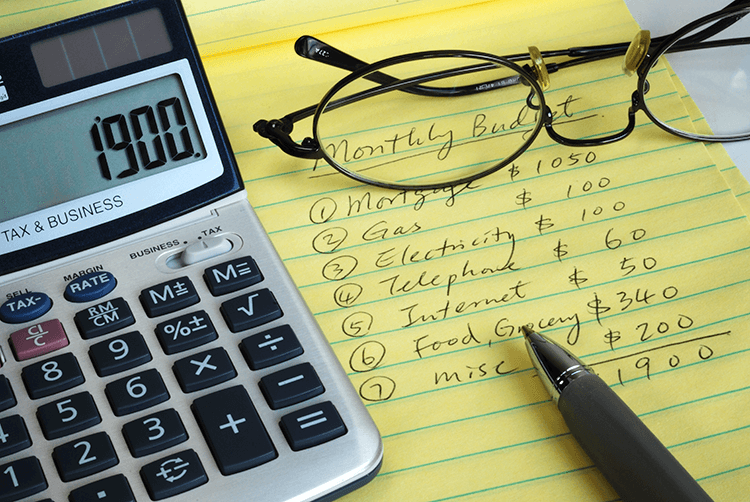

Start a Budget

A good budget is the best way to get out of debt. Knowing what you spend and what you make allows you to allocate your money better. If you have a pressing debt, go to your budget and see where you can stop spending.

With luck, you can eliminate your debts quickly once you know exactly how they impact your finances.

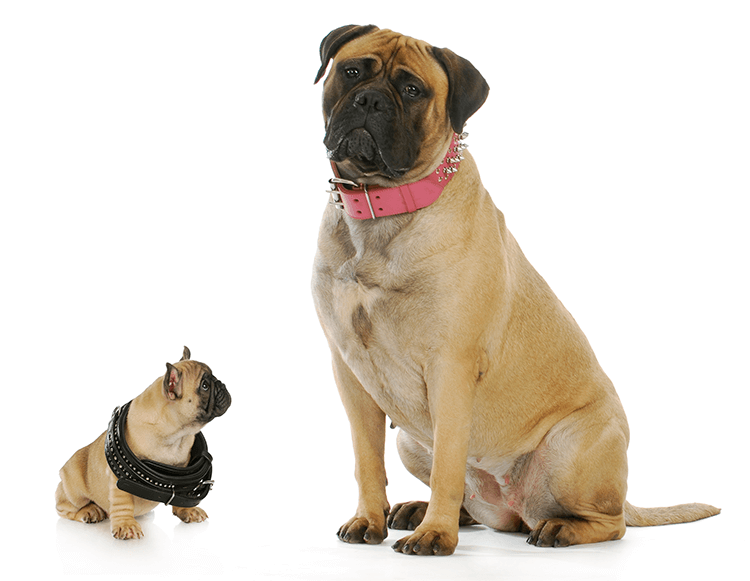

Snowball Your Debt

The debt snowball is a time-honored tradition. The gist of this technique is that you must eliminate small debts first to free up funds that will allow you to eliminate larger debts.

While not particularly helpful for those who need to pay off a significant debt immediately, it is an excellent way to get rid of smaller debts while positioning yourself to attack the larger problems.

Go Big to Little

Another good strategy is to start big. Find your biggest debt and chip away at it. In time, that huge debt will go away, and you can take everything you’ve saved to eliminate smaller debts more quickly.

It feels like it’s slower going than the previous tip but just as effective.

Take Out a Personal Loan

Personal loans can be dangerous if taken out without research. There are a few good companies that offer personal loans with reasonable rates, though, and they can help you get out of a jam.

Use these companies sparingly, though, and only as a way to get out of debts that have to be paid off right now.

Balance Transfer

Balance transfers are a great way to reduce some of your debt. While you’ll still owe the same amount of money, you might cut down on the interest that you owe. This swap means you’ll pay less money to clear your debt over time.

You may want to close the second card after a balance transfer, but beware – closing an older card can hurt your credit score.

Grab a Gig or Side Job

A second income stream can be dedicated directly towards your debts. Gigs are easier to get than ever, with companies like Uber and Postmates hiring all the time. If you have any particular skills, try to turn them into a side job for paying off your debt.

From photography, writing to web design, you can find ways to generate more cash for your plans.

Downsize

Getting rid of debt is often a matter of having more available money. One of the best ways to do this is to downsize your life.

If you can move into a cheaper home or trade in your car for something with a smaller payment, you can spend that money on your debt and eliminate it much more quickly.

Have a Garage or Yard Sale

A good garage sale is a great way to generate quick money. Take the items in your home for which you have no use and turn them into debt-breaking cash. If you are electronically inclined, you can sell some of your better items online.

It’s an excellent way to clean out your home and make money to pay off your debt at the same time.

Double Down

Making a second payment on your debt every month will help you to make it disappear quickly. While your first payment will likely go mostly towards interest, your second payment will go entirely towards principle.

This extra amount will erode the base of the loan and help shrink down the balance very quickly. Even if you can’t double down, try to throw a little extra at the principle every month.

Cut the Fun

Make sure to start cutting your spending, starting with entertainment. Does this mean you have to have a boring life when you are paying off debt? No, but it does mean that extravagances need to go first.

Take some time to look back at that budget and figure out how much you spend on entertainment. If you can put half that money towards your debts, you’ll be out of debt much faster.

Use Found Money

Do you ever get monetary gifts? A few bucks for your birthday or a bonus around the holidays? Instead of treating yourself, throw this money at your debt.

Since this is money that you didn’t expect to have, you won’t miss it.

Make sure that this is an extra payment, not a replacement for your payment. If you throw extra money at the debt, it will go away all the sooner.

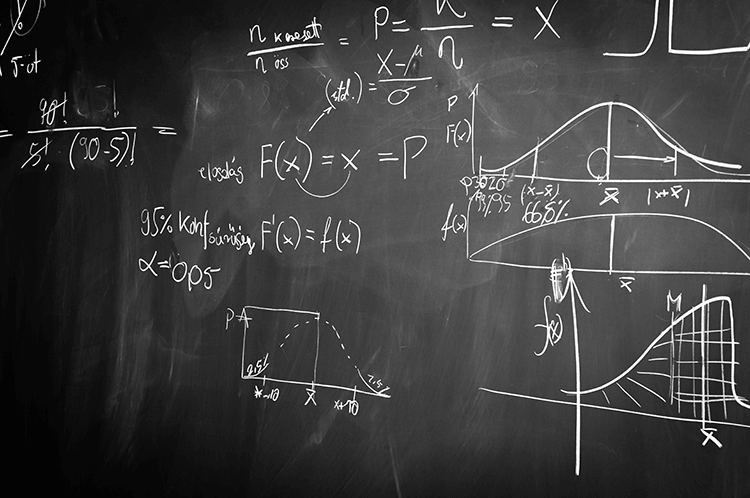

Do the Math

Start by looking at the interest rates on your debts. Always pay off the debts that have the highest rates first. This will help to cut down on your payments and allow you to get out of debt faster.

If these loans have high balances, getting rid of them quickly will help you out in the long run.

Negotiate

Finally, take some time to figure out what you have to pay off. If you owe money to a creditor, find out how much you’ll have to pay to make the debt go away.

Most creditors would rather take a partial payment all once than depend on you to keep paying off your debt for years. While this might be an up-front expenditure, it will help you over time.

—

I hope these ideas will help you to pay off debt fast. Remember to get angry and attack the debt with fury. A sound financial background will help you maintain peace and stability in all areas of your life.