Life is full of unexpected twists and turns. Some of these unanticipated experiences can be pleasant, beneficial or exciting in different ways, but others may be difficult to deal with or even devastating.

Life is full of unexpected twists and turns. Some of these unanticipated experiences can be pleasant, beneficial or exciting in different ways, but others may be difficult to deal with or even devastating.

From car accidents to job losses and many other events that could occur with no warning, the financial impact can add to the other stresses that you may experience at these times.

You may be inclined to think that these unexpected events cannot be planned for because you do not know what may happen or when the events may occur. However, it is not reasonable to expect to walk through every day of your life without experiencing at least a few of these issues along the way. Therefore, you actually can and should expect and plan for them.

Do not leave yourself or your family unprotected against financial storms… Build up savings.

– Ezra Taft Benson

One of the primary steps that you can take to prepare for the financial impact that they could have on your life is to create an emergency fund. Now that you know that reserve savings are essential, how much money should you have in your emergency fund?

Understanding Why You Need an Emergency Fund

Almost all types of stressful or devastating life events can impact your finances in some way. For example, if you get injured in a car accident, you may have to pay your insurance deductible and take time off of work to recuperate from injuries.

If you lose your job, it may take months before you can find a new job. During this time, you still need to pay your bills. Even if you experience the loss of a close relative, you may need to take time off of work to cope with your loss and to make arrangements.

Many people do not keep enough money in their checking account to pay for the expenses that these types of events may create. Without an emergency fund to cover your costs, you may have to accrue a sizable amount of debt to stay afloat.

You may even have to pay bills late, and this could damage your credit rating, result in repossessions or foreclosures and more. You just cannot afford to overlook the importance of creating and funding an emergency savings account to prepare for any situation.

Determining Your Minimal Financial Needs

Before you fund your account, you need to ask how much should you have in savings and other liquid assets. Each person has unique financial needs and considerations, so there is not a catch-all answer.

As a good rule of thumb, however, you should have enough money to pay for at least three months of your expenses readily available to access at a moment’s notice. This amount should be a good starting point, but you also should gradually increase your emergency fund so that you can pay for up to a full year of monthly expenses.

If your expenses increase, you should likewise increase the amount of money that you have available in your emergency fund.

Planning for More Extensive Financial Emergencies

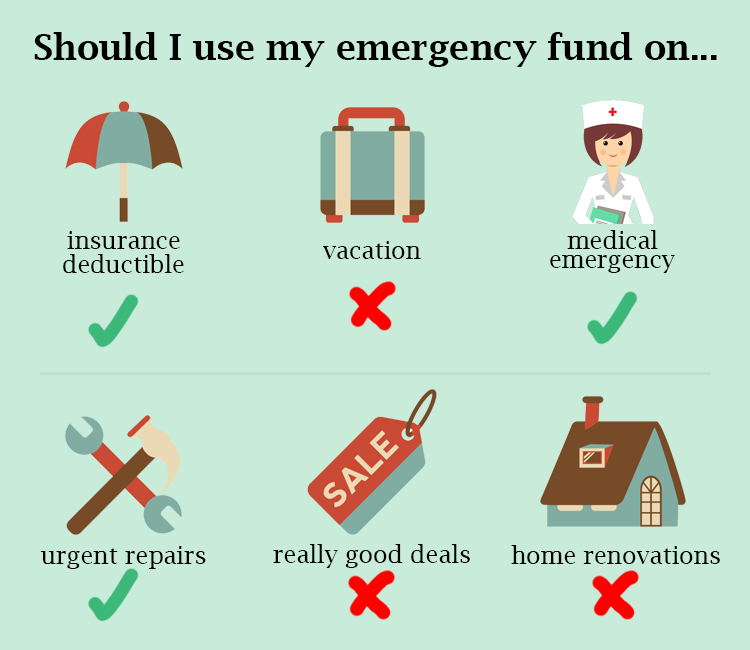

Some emergencies may require you to take time off of work or may result in the loss of your job. Keep in mind that some situations may also create additional expenses. These may be vehicle repairs, insurance deductibles, funeral expenses, medical bills and more.

One of the best ways to plan for events that may be difficult to anticipate is to buy multiple types of insurance. For example, you can purchase life insurance for all of your family members.

This coverage may provide you with money for funeral expenses, reimbursement for lost wages while you cope with the loss and more. Car insurance, health insurance, home insurance and more are also available.

Remember to plan for out of pocket costs if you intend to use insurance to cover losses. For example, you may need to increase your monthly expenses to account for the premiums. By doing so, you will need to boost your emergency fund balance accordingly.

Also, many types of insurance require you to pay a deductible. Your emergency fund should have enough money to pay for your monthly expenses for several months or more as well as your insurance deductibles. It can take time to save up all of this money. Making slow and steady progress through regular savings efforts is a smart idea.

When to Use Your Emergency Fund?

According to Dave Ramsey, your emergency fund should only be used when the need is unexpected, necessary and urgent. If it is something you can plan for, don’t dip into your savings.

Determining Where to Keep Your Emergency Fund

You may also wonder where to keep your emergency fund. An emergency fund could range from a few hundred dollars initially to several thousand dollars or more. A substantial emergency fund may even have tens of thousands of dollars in it.

If you are financially savvy, you understandably may not want to keep such a significant amount of money in a typical savings account that has a low-interest rate. One way to maximize your return on your emergency fund is to look for a high-yield savings account.

These accounts may require you to maintain a high minimum balance to qualify for the superior interest rate. You can also put the money in a money market account, which may have a higher rate of return.

Remember that you likely do not need access to all of your money at the same time. For example, you could save enough money to pay a month’s worth of expenses in your regular savings account, which you may be able to access at a moment’s notice easily.

You may place additional funds in a higher-yield account that may be slightly more difficult to access. This placement is a wise decision. After all, if you are an impulse shopper, you do not want to be able to spend that money easily. You can also store additional funds in a short-term CD or bond.

How to Save for an Emergency Fund

If you don’t have enough money saved up for a decent emergency fund, I suggest you start with what you have now. If you have any cash at all keep it in a safe place until you can get it to the bank.

Don’t spend your hidden money. Resist the temptation.

I would suggest you look over the list of ways to get money today if you want to get started on building up your emergency cash immediately.

Pack a lunch, go without Starbucks for a few days. Keep holding on to any cash you get and continue to squirrel it away.

Start looking down the road a little bit and see what you can siphon from your next paycheck into your fund.

Little steps like these will get you to a comfortable level quicker than you think. And once you get there the feeling of security is worth it.

—

Planning for emergencies is a smart idea, but many people fail to do so. To manage your stress level at these critical times, you need to be financially prepared. Being fully prepared for any situation allows you to sleep more peacefully each night.

—

Image for Pinterest: