Everyone knows what dividends are. These are the profits that a company passes on to its shareholders (that’s you!).

Many investors prefer to invest in dividend-paying companies because of this regular cash infusion into their brokerage account. The cash can be used for living expenses or can be reinvested in their favorite stock at that time.

But there is a more in-depth dividend strategy that some savvy investors use. It is called the dividend growth investing strategy. It boils down to investing in companies that have a history of continually raising their dividends.

The Benefits of Dividend Growth Investing

Why is dividend growth investing liked by so many?

1. Income

The income that is paid can be used to support their lifestyle. Once your nest egg gets large enough, you can live off your dividends. The rule of 4 comes into play here.

2. Strong Companies

Two, companies that continually raise their dividends tend to have strong balance sheets and aren’t likely to fold. This strength helps to protect your base capital.

3. Inflation Protection

Investing in dividend growers acts as a hedge against inflation. If you invest in a bond or other fixed-income investment, inflation will continually eat away at the value of your principal.

When you invest in companies with growing dividends, your income increases and can help maintain the value of your original investment.

4. Hands Off Strategy

Three words: Buy and Hold. Brokerage fees can eat away at your returns. If you want to reduce brokerage fees, you need to trade less frequently.

As a dividend growth investor you will be typically buying companies for the long term. Putting your capital in 10-20 dividend growth companies and letting it sit for years is not only easy on the mind it saves you money in fees.

Examples of Dividend Growth Companies

Here are a couple of companies that have track records of raising their dividends over the long term.

Procter and Gamble (PG)

Procter and Gamble is an American multi-national consumer goods corporation headquartered in downtown Cincinnati, Ohio, founded in 1837 by British American William Procter and Irish American James Gamble. It primarily specializes in a wide range of cleaning agents and personal care and hygienic products. source

P&G has been paying out increasingly higher dividends for 43 years. Their average dividend increase since the year 2000 is 8.8%.

They make goods people use on a daily base and need to be replenished. These are products like paper towels, soap, and detergent. So they have a ready market far in the future. This fact should make for steady, reliable earnings.

Johnson and Johnson (JNJ)

Johnson & Johnson is an American multinational medical devices, pharmaceutical and consumer packaged goods manufacturing company founded in 1886. The corporation includes some 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries. source

Talk about another strong market: healthcare. Everyone is going to need medical attention one day, and JNJ will have the products to serve them.

They have increased their dividends for the past 55 years. The average dividend increase since the year 2000 is 10.63%.

—

I own both of these companies, and it feels like money in the bank when I purchase more shares. I can count on them to be reliable payers because of their past track records and the markets they are involved in.

How to Find Reliable Payers

So how do you find companies that reliably increase their dividends over time? I start my search with the Dividend Aristocrats list. This invaluable, but free, guide lists all the companies that have increased their dividends for at least 25 years. Right now the list has 51 companies.

The Royalty of the Dividend World

You can find the Dividend Aristocrat list at Simply Safe Dividends.

If 25 years is not enough history, you can use the Dividend Kings list to find rock-solid companies. The kings are companies that have increased their dividend for the past 50 years.

A lot of these companies have low yields as there is always a ready buyer pushing up the stock price. If you are looking for value, I would start with the up-and-comers who have increased their dividends for the past ten years. Dividend.com maintains a list of those stocks here.

Dividend Fundamentals

When I am purchasing dividend stocks, I look at a couple of factors before I invest. These include:

- Payout Range: This is the percentage of earnings they are paying for dividends. The lower the number, the more room they have to increase the dividend. I try to find < 60% payout stocks.

- Debt Load: I look at the amount of long-term debt a company is holding. I am pretty risk averse, so I like this number to be as close to $0 as possible. This factor may cut into growth potential, but I sleep better at night.

- Yield: What is the dividend when divided by the share price? The higher the number, the more you will earn per dollar invested. I look for over 2%. Beware of 5% for non-REIT companies; this could mean the share price is tumbling for other factors.

- 5 Year Dividend Growth Rate: This is the average annual compound dividend growth for the last five years based on the last paid dividend and the corresponding dividend five years earlier. I start my search at 2%.

Of course, these factors are not all of the research you must perform to find a good stock. You will still need to look at their market and revenue trends along with insider purchases. I would start by downloading their annual reports and looking over the numbers.

Easy Dividend Research

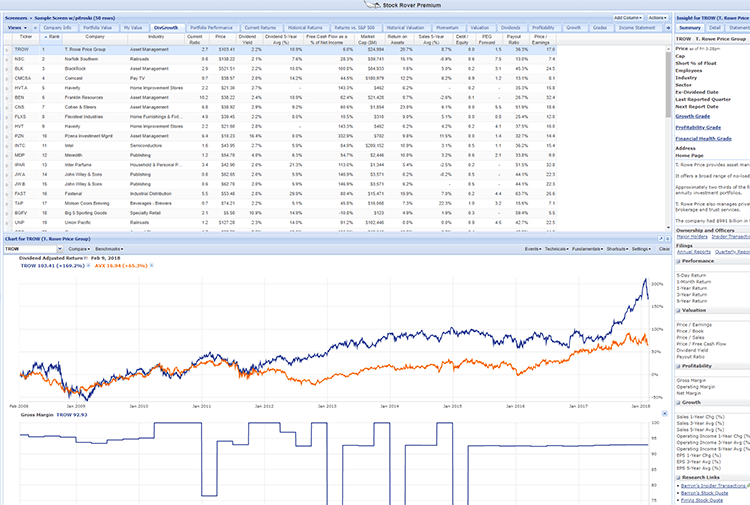

One tool I find really helpful for researching stocks to purchase is Stock Rover. The free version allows you to create watchlists and list stocks by their fundamentals for comparison.

The real power of this tool is with the premium version. It allows you to create custom formulas and criteria and rank stocks according to them. This function will give you a list of the best 50 or so stocks to start looking into very quickly.

—-

I hope this gives you a good headstart into the world of dividend growth investing. I believe it is one of the best ways to invest. It allows you more hands-on experience than just investing in an index or mutual fund.

Part of what keeps me motivated to save and invest is researching and figuring out what stocks to purchase. Of course, watching those monthly dividend payments roll in doesn’t hurt either.